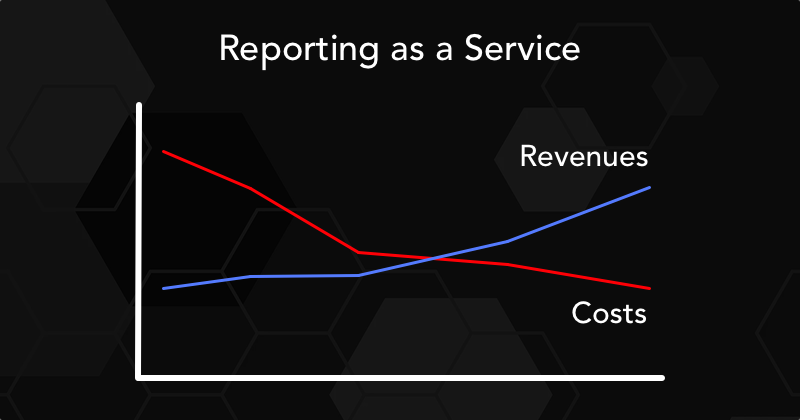

Much has been written and continues to be written about the relentless pressure on fees, revenues and therefore profits for investment firms. In simple terms it’s profits that drive shareholder value, and there are only two primary levers that drive profits: revenues and costs.

Maintaining and increasing profits is obviously easier said than done and looking for ways to increase revenue doesn’t generally go hand in hand with a solution that also reduces operating costs. Typically, there are entirely separate initiatives pursued within an organisation; one to increase revenues and another initiative to reduce costs. Uniquely Reporting as a Service from Opus Nebula does both; reducing monthly operating costs while increasing revenue generation opportunities. Continue reading to find out how.

Considering cost reduction first:

Most investment firms are also suppliers, managers and developers of their technical infrastructure and computer systems and despite the best efforts of the team to run a lean and efficient operation, there is little opportunity to achieve significant economies of scale or for the team to specialise in a particular domain and therefore generate benefits from further expertise and efficiencies. IT support and development teams typically juggle competing priorities and projects; enhancements, upgrades, maintenance and support in addition to managing the day-to-day business as usual workload. Imagine if all of the responsibility for the technical environment and system that delivers all the client and fund reporting could be outsourced to an expert provider. And for that provider to deliver all the set-up, maintenance and security for the technical infrastructure, to dynamically scale the power and capacity of the system to match your requirements and needs, and for the provider to support, maintain and develop the client reporting system to your precise requirements and for the system to produce reports exactly as required by your clients.

Reporting as a Service is a cloud-based reporting solution that provides all of these services and the benefits they give. The cloud infrastructure that hosts the system is Microsoft Azure, which facilitates a cost effective, secure and powerful processing and storage solution. The expertise within our team is focussed on providing and developing this service. There are no competing priorities with other services and requirements, and our proficiency is proven to deliver faster and better client and fund reporting solutions. Due to the economies of scale afforded by this model, the service is significantly cheaper than an equivalent in-house or 3rd party on premise model. Our clients simply login via the internet and use the system to manage and control the entire end to end reporting process. It is highly automated and allows the reporting team to manage and produce many more reports than is possible via a more manual or legacy reporting process.

Now moving to increasing revenues:

It is widely recognised that client reporting, in all its forms, provides one of the most frequent and regular interactions between an investment firm and their client, and it therefore remains one of the most important forms of communication. Whether delivered as a printed report, an electronic file such as a PDF or Word document, or via a portal or web interface – or perhaps a combination of many formats. The key is that the investment firm must be able to provide relevant, useful and timely information whilst maintaining consistency and accuracy, and all of this in the format(s) required and using the medium requested by the client. Providing excellent, high quality, informative and timely reporting to clients for their investments, in the clients’ language and delivered in a way the client wants to receive it equals good quality client communication. This forms part of delivering high quality client services leading to an improved client experience and results in higher levels of client retention and attracts further investment mandates, increasing revenues to the firm.

Similarly, providing Sales and Account Management Teams with material and pitch books automatically updated and available in all the required languages to the same high-quality standards to support investor and sales meetings will consequently increase sales, client investment and therefore increase revenues for the investment firm.

In summary: Reporting as a Service brings both cost savings and scale increases combined with revenue increasing opportunities. The cloud-based system provides investment firms with a complete end to end client and fund reporting solution, that is flexible, scalable and future proof. By providing reporting of the highest quality to their clients, investment firms can expect greater client retention and increased investment.

To find out more about Reporting as a Service and the many ways it can benefit Wealth and Asset Management firms please visit our website at www.opus-nebula.com and email [email protected] to arrange a meeting and see a live demonstration of the system.