Reporting as a Service®

Our UK based team has developed the latest generation of reporting solution for the investment management industry.

Reporting as a Service provides investment firms, wealth managers and asset servicers with a world-class reporting solution without the costly overhead of managing, maintaining and developing the reporting system themselves.

The “as a service” delivery model significantly shortens the elapsed time to go-live as well as reducing the on-going costs and risks. On-boarding is typically completed in 6-8 weeks. Once set-up investment firms manage and control their reports and the production process using our automated “best practice” workflows and suite of user dashboards, adding commentary and content to produce client packs and fund reports to their precise layout, content and branding.

Reporting as a Service is cloud-based, secure and resilient, and available 24 x 7 for your teams to produce regulatory reports and bespoke reports for your clients, funds and investors, at whatever scale you require.

Reduce Risk | Improve Reporting | Cost Effective | Future Proofed

Please take a look over the site and when you’re ready, get in touch with us to discuss your reporting and to arrange a demo.

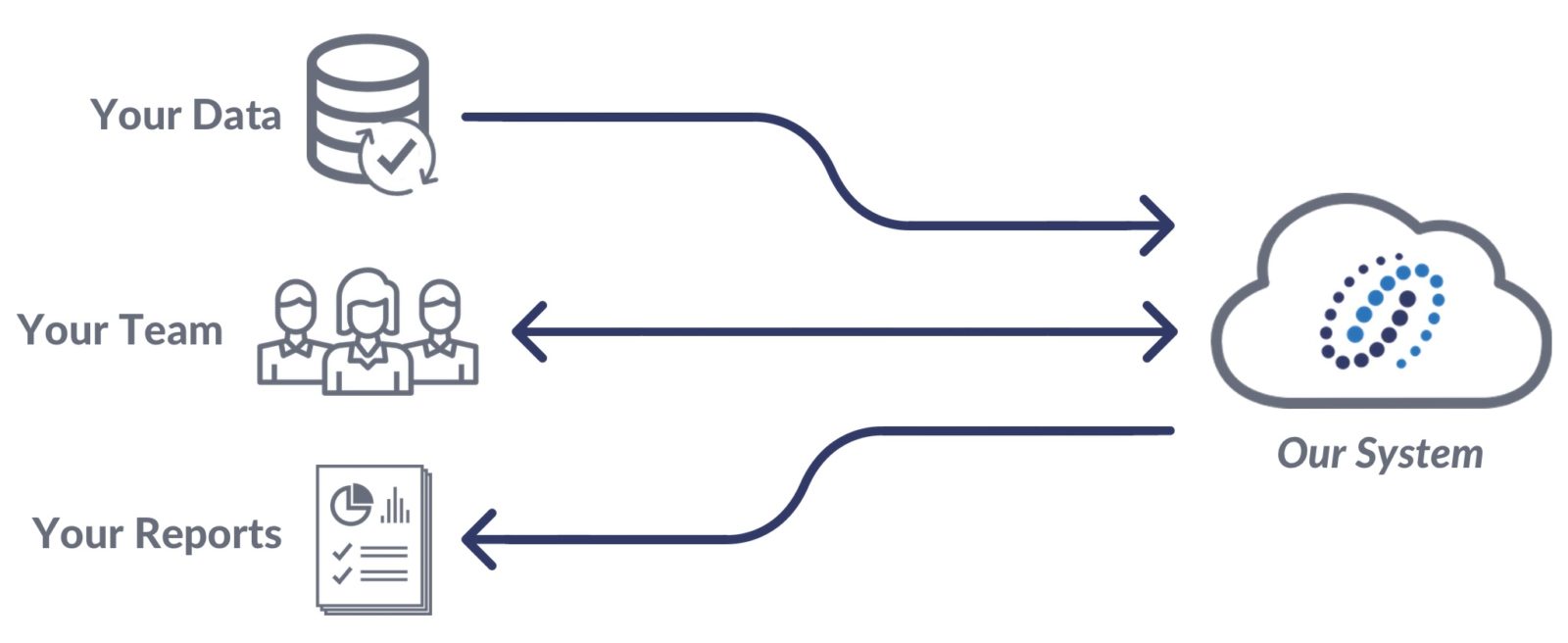

Reporting as a Service is designed to improve and simplify your client, fund and regulatory reporting. Like all great solutions, our reporting service is simple to understand and use; Your data, your team, our system, your reports.

Your Data

Reporting as a Service is proven to integrate quickly and easily with your existing data feeds and data stores – whether internally sourced or from an appointed third party. Data validation rules are simply configured to help ensure your source data is complete, accurate and ready for publishing.

Your Team

The fully automated solution allows your reporting team to control the entire production process, from data ingestion, through report rendering, report review, approval and automated distribution of the completed reports. The efficiency of the solution frees up time for the reporting team to add value elsewhere and transform the overall client experience.

Our System

We are responsible for the reporting system and ensure it is available to your teams 24×7. Reporting as a Service is securely hosted in the cloud and your team login via a standard web browser. The solution continues to evolve, so that today’s reporting requirements and those of tomorrow are simply accommodated. Specific changes and enhancements to your reports are swiftly delivered by our technical team.

Your Reports

We configure the report templates to your precise layout, design and branding. The templates dynamically flex based on your data and your rules to produce highly bespoke reports, at scale, for each of your clients and funds. The automated distribution process means that your reports are delivered on time, every time. Each report has an individual audit trail, detailing every step in the production process.

Typical Regular and Ad Hoc Reports

Reporting as a Service has the flexibility, power and capacity to produce a variety of reports at scale, including:

- Valuation Packs/Quarterly Investment Reviews/

Portfolio Valuations - Meeting Papers/Pitch Books

- ESG Reporting

- Regulatory Reporting/KIIDs/KIDs etc.

- Fund Factsheets/Product Term Sheets/

Extended Factsheets - Performance and Risk Reporting

- Investment Commentary

- Client Letters

Watch our 90 second video to learn more about Reporting as a Service.

Is your firm truly efficient?

Read our ebook to learn how unnecessary complexity affects your business.

We are proud fintech members of The Investment Association “engine” program.

We’d like to get to know you better.

If you have any questions regarding our Reporting as a Service solution, please let us know by clicking the button below. Is your firm currently facing any particular ‘pain points’ with your existing client and fund reporting system? We would be happy to arrange a call or meeting to discuss them in greater detail and explain how our cloud-based reporting solution may be the answer.