What is the link between a “blank piece of paper” and an “iceberg”?

This is indeed a strange question and there appears no clear or obvious link, perhaps even less obvious and less clear as it relates to client reporting?

The blank sheet of paper…

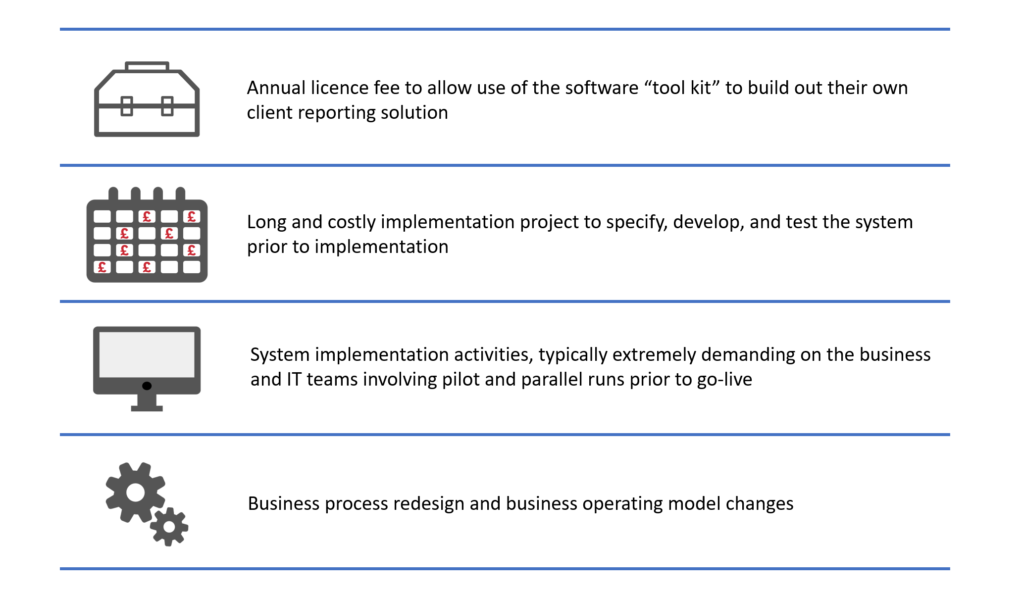

Many client reporting systems available today to investment firms are “tool kit” solutions. Typical characteristics of this type of system include:

Hence the reference to the “blank sheet of paper” – with a tool kit client reporting solution the investment firm must define, build and implement the entire client reporting system – from scratch. Typically, this takes 6-12 months or more, from start to finish, depending on the size and complexity of the implementation. Given most firms are currently looking for operational efficiencies, cost savings and a quick time to market for client servicing improvements, this probably isn’t the most effective option going forward.

So, the “blank sheet of paper” refers to the “tool kit” reporting system, that needs to be defined, documented and built. Of course, a blank sheet of paper may also be used to make a paper boat.

The iceberg…

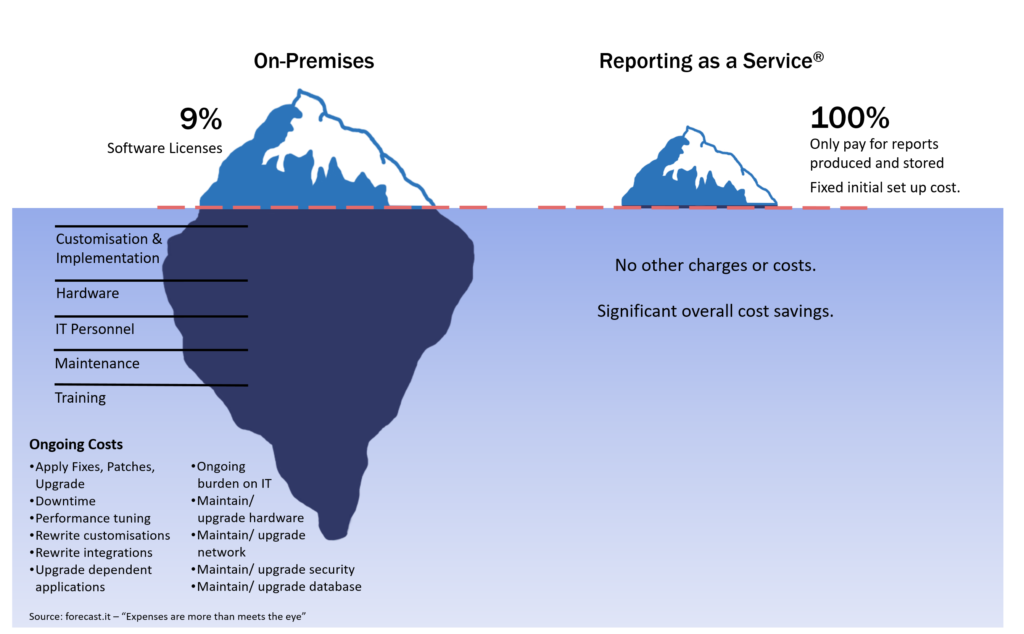

Moving now to the iceberg. It is recognised and published* that the annual software licence fees of a typical tool kit client reporting solution generally represent less than 10% of the overall cost to an investment firm of the total spent on the client reporting system. Thus, the overall cost of developing, maintaining and enhancing the reporting solution typically equates to a massive 10 times the cost of the annual licence fees. Rather like an iceberg – the bit you easily see (the bit above the water in the case of the iceberg), in the case of the client reporting tool kit solution, the annual licence fees – only represent a small fraction of the overall cost of a buy and build client reporting solution.

*Source: forecast.it – “Expenses are more than meets the eye”

In many ways this is not surprising, of course it is going to take a lot of time and money to define, build and implement a completely bespoke client reporting system. However, do firms truly need a completely bespoke solution, and the additional cost, effort and time that goes with it?

It has been suggested, and proven, that much of the reporting system and operational process is the same for all firms – and huge savings of cost and time can be gained if a more efficient solution can be identified.

So, what’s the opposite of a blank sheet of paper and the iceberg? What is the solution to this? Why hasn’t it been done before?

Rather than buying a tool kit client reporting solution and building the solution from scratch, firms can now use a complete end-to-end client reporting solution – pre-built, live and ready for specific elements to be configured to your precise requirements. This system contains business best practice workflow, report scheduling screens, data tracking control panels, summary dashboards, report libraries and so much more – all out of the box, and just require a number of weeks to configure to your precise requirements. This is Reporting as a Service.

No more blank sheets of paper – these are replaced with a fully functioning end-to-end reporting solution.

No more iceberg – where the annual licence fees represent approximately 1/10th of the overall system costs, with the other costs being 10 times greater. With Reporting as a Service there are fixed set-up costs and a pay per use model. So, you only pay for the reports you produce and store. Discounts apply to higher volumes.

No more iceberg – where the annual licence fees represent approximately 1/10th of the overall system costs, with the other costs being 10 times greater. With Reporting as a Service there are fixed set-up costs and a pay per use model. So, you only pay for the reports you produce and store. Discounts apply to higher volumes.

Finally, answering why hasn’t this type of service been offered before – this is largely because of technology. Advances in cloud technology and security, and acceptance of this within the financial services industry has facilitated the Software as a Service model for client reporting and for use within investment firms.

Reporting as a Service explained in more detail…

Reporting as a Service is a world-class reporting solution securely hosted in the Microsoft Azure cloud. Our solution contains all the features you would expect of a truly world-class reporting system, and some that perhaps you hadn’t thought of.

On-boarding to Reporting as a Service is measured in weeks, just enough time for us to configure the reports and portal to exactly match your content, layout and branding, to configure our powerful data loaders to import and validate your data and finally to configure the automated report distribution. The entire reporting process is controlled and managed by your business users, using simple and straight-forward dashboards – all pre-built and available out of the box.

Our initial set-up costs are fixed, and then you only pay for the reports you produce and store. No more huge project and system costs, these are replaced with a simple tariff, with volume discounts. Our set up process is highly repeatable and measured in weeks not months or years.

To find out more about Reporting as a Service and how it benefits Wealth and Asset Management firms please visit our website at www.opus-nebula.com and email [email protected] to arrange a meeting and see a live demonstration of the system.