ESG investing is often thought of as a recent phenomenon, but it has been around for centuries with religious groups such as the Quakers and Methodists using forms of negative screening back in the 17th and 18th centuries. More recently in the 2000s, climate change, in particular, gained attention from governments, regulators, investors, businesses and the public more generally. A strong influence at the time was the Stern Review on the Economics of Climate Change published in 2006 that concluded that climate change is the greatest and widest-ranging market failure ever seen. Today we see the result of this growing focus on climate change with many businesses reporting CO2 emissions as well as ESG client reporting from investment managers focusing heavily on climate change.

We can probably agree that progress has been slow and our current efforts are far from enough to prevent greater climate challenges. Nevertheless, the investment community has started addressing two additional important parts of ESG. Namely biodiversity and social. But if you are up to speed with the latest trends in ESG client reporting, you know that this isn’t a new trend as such. So, what do we mean by biodiversity and social and what is the latest on these topics?

Biodiversity

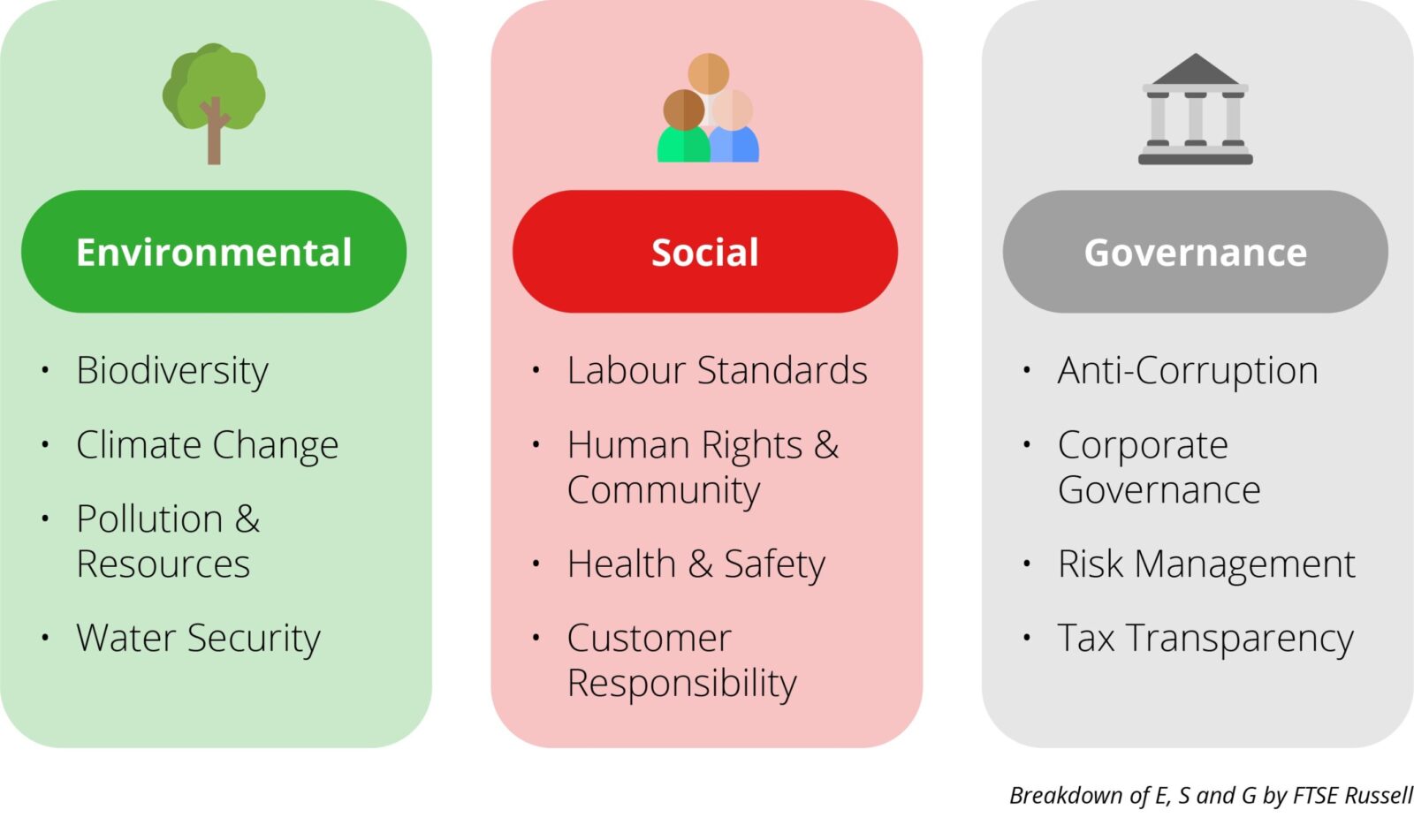

Biodiversity is simply put the variety of life on earth, and together with Climate Change it is part of the ‘E’ in ESG. Biodiversity ensures that we have clean air, fresh water, good quality soil and pollinated crops, and it also helps us fight climate change. A cynic might wonder why this matters to investors – but it matters hugely! 50% of global GDP is dependent on biodiversity and 75% of global food crops rely on animal pollination, meaning that most businesses are directly impacted by changes to biodiversity. Additionally, wetlands, forests and oceans absorb a large amount of carbon every year (5.6 gigatonnes or 5600 million tonnes. For comparison, the UK emitted 417.1 million tonnes of carbon equivalents in 2022), meaning that they are essential in the fight against climate change.

So how can we measure and report on our investments’ contribution to biodiversity? Well, this is currently a significant challenge as biodiversity does not come with an obvious unit as for carbon emissions. Furthermore, there is currently no international framework on how to go about measuring biodiversity risk, impact and loss, and multiple different methodologies are being used (you can find some of them here), meaning that it is challenging to compare companies. Nevertheless, ESG data providers, such as MSCI, provide flags on companies with biodiversity risks and the Taskforce for Nature-related Financial Disclosures (TNFD) is planned to be published in September this year. It is therefore recommended that the TNFD is used as the guidance for nature-positive investments. And you might as well get started as biodiversity reporting is expected to be as common as reporting on carbon emissions within the next 3-5 years.

Social

Social is the ‘S’ in ESG, and it covers the ways companies interact with employees and the communities in which they operate. With respect to employees this means health and safety, diversity, equity and inclusion as well as labour relations. Outside of companies, this means relationships with community leaders as well as policies, supplier standards (e.g. policies against child labour and modern slavery) and product safety.

In a 2022 survey by BNP Paribas, more than half of global institutional investors surveyed said that social issues were the most difficult to integrate in investment analysis. The challenge is the same as for all other topics related to ESG investing: data. Although there is growing regulation around companies having to report social data, availability is still limited, and it can be challenging for investors to compare companies as they often, just like the rating agencies, use different methodologies.

Nevertheless, the ‘S’ has gained increasing focus over the past years, and especially the Covid-19 pandemic highlighted a number of important social issues. The pandemic had a much larger impact on women and people with lower incomes, and it started many important conversations about wellbeing, health and traditional work structures. Furthermore, value alignment is more important to consumers than ever, and this means that they are also more likely than ever to boycott products and services based on value mismatch (evidenced by both the recent Boohoo and Shein scandals). Today’s consumers and employees alike expect companies to take stances on social topics well beyond the products and services they provide.

Not considering the ‘S’ in ESG can have huge impacts on a company’s reputation and returns, whereas taking the ‘S’ seriously can result in deeply engaged and committed employees and customers. This is, for example, evidenced through PayPal’s comprehensive consideration of the social needs of their stakeholders (an interesting article on the topic can be found here). They have taken strong stances on LGBTQ equality and guns, as well as implementing reduced costs of health care benefits, giving all employees stock (and therefore company ownership) and bringing all US employees up to a liveable wage.

The ’S’ might not historically have received as much attention as the ‘E’ and the ‘G’, and that is likely due to the climate challenges we are quickly heading towards. Nevertheless, as we continue to focus on the ‘E’, it will be more important than ever to ensure that we are brave enough to also take strong stances on the ‘S’ as we cannot sacrifice one for the growth of the other.

Reach out!

At Opus Nebula we are knowledgeable about the latest trends with respect to ESG client reporting and are always ready discuss current developments with our clients and prospects. If you would like to discuss this further, please feel free to reach out to us here.